Wills, Estates, Trusts, Adoption, and Name Changes

We help clients plan for the efficient and effective transfer of assets to spouses, family members, friends, charities, etc. This may involve the preparation of last wills and testaments, living wills, or powers of attorney.

When commencing the planning process, you must consider your intentions, your family relationships, charitable inclinations, and the relationship of federal and state estate tax, gift tax, and generation skipping transfer tax laws. We will discuss the appropriate plan to meet your goals and begin preparing the necessary documents to execute and implement your desired plan.

Most people wish to maximize their estate for the benefit of their loved ones, spouses, children, parents and/or siblings. A proper will and estate plan should consider not only to whom you want to give your estate, but also the present and estimated future estate distribution value and consequences.

Please call us for a consultation/evaluation.

Estate Administration

We can also assist in handling the administration of estates on the various issues, including:

- Assistance to the executor with the preparation of the required probate documents and assist in valuation of estate assets

- Filing insurance claims

- Preparing final income tax returns and the estate’s income and federal and state estate tax returns.

- Arranging for the distribution of the estate’s net assets

A person’s estate is comprised of all of their assets for estate accounting purposes, even if they pass to a beneficiary directly outside of the distributions set forth in your will. Assets include properties, bank accounts, retirement accounts, trading accounts, life insurance proceeds and personal property.

We can help you through this difficult process. Please call us for a consultation.

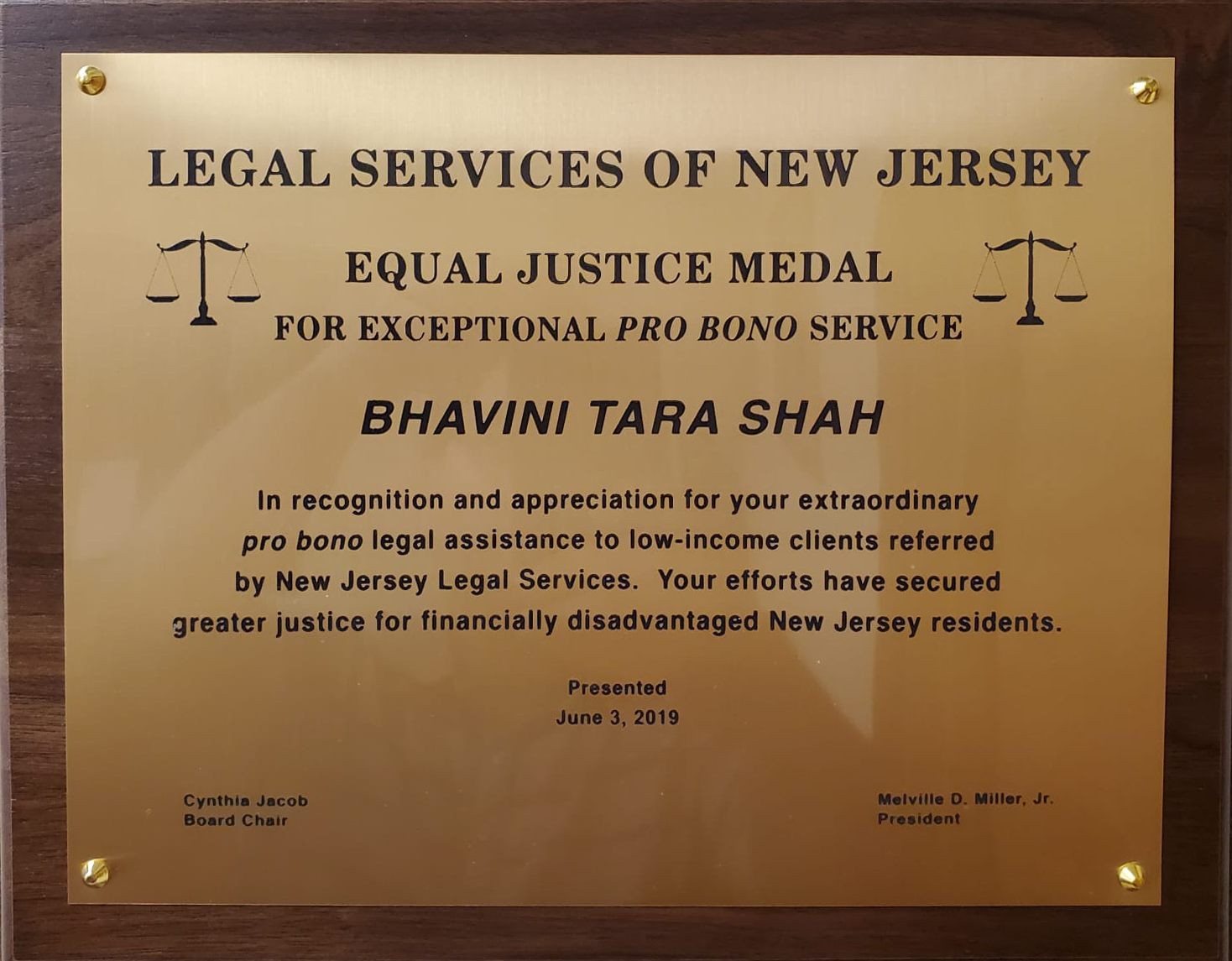

A reputation based on results with individualized service

Call The Law Office of Bhavini Tara Shah, LLC for an Experienced New Jersey Lawyer